COBC Lien Resolution

How a Coordination of Benefits (COB) lien arises during the pendency of a Workers’ Compensation, Liability or No-fault case.

42 U.S.C. §1395y(b)(2) and § 1862(b)(2)(A)(i) and § 1862(b)(2)(A)(ii) of the Social Security Act, states that Medicare may not pay for a beneficiary’s medical expenses when payment “has been made or can reasonably be expected to be made under a workers’ compensation plan, an automobile or liability insurance policy or plan (including a self-insured plan), or under no-fault insurance.” Medicare may make a “conditional payment” if the claim is denied or payment isn’t timely made. Such payment is subject to future recovery upon “subsequent settlement, judgment, award, or other payment”.

During the course of an injury case, Medicare may pay medical bills for injury related care in the following instances:

- The claim is denied by the Carrier

- The Carrier did not pay the bill promptly

- The beneficiary elects to pursue unauthorized treatment

- The beneficiary fails to document the fact that other insurance exists

- The provider mistakenly bills Medicare

- The beneficiary fails to file, or improperly files a claim

- There is a long delay between the occurrence of an injury or illness and the decision by the Court

MSP Compliance:

1. Report the Claim:

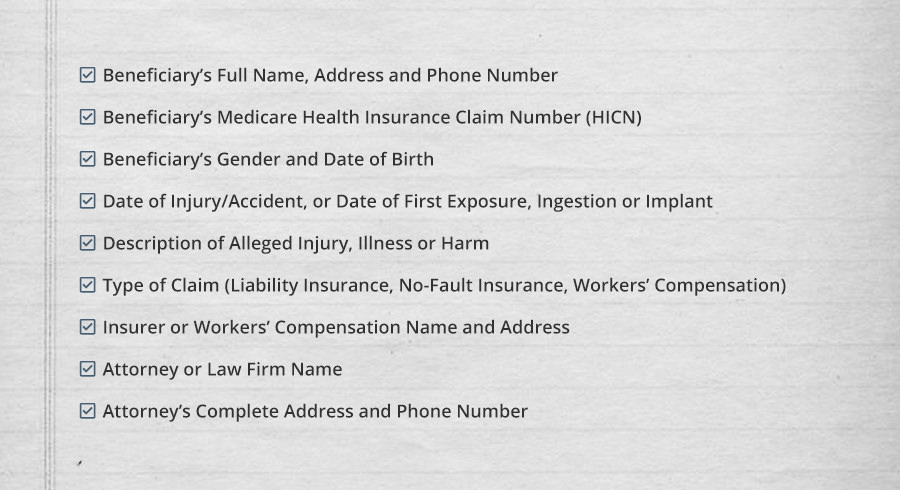

In order to comply with the MSP Statute, Medicare beneficiaries must notify Medicare when a claim is made against an Insurer for a liability, no-fault or Workers’ Compensation case. This obligation is fulfilled by the beneficiary or his/her attorney contacting the Benefits Coordination & Recovery Center (BCRC). The following information must be supplied:

The BCRC will then transfer the claim to the Commercial Repayment Center (CRC).

2. Review the Conditional Payments:

The CRC will search and identify claims Medicare has paid that are related to the injury in question and issue a Conditional Payment Letter (case has not yet settled) or Conditional Payment Information (case had settled at time of reporting). The Beneficiary or his/her attorney should review the Conditional Payment for any discrepancies and negotiate removal of inappropriate items. Requests must be sent in writing and must include medical documentation. Basis for negotiation includes the following:

- The claim paid by Medicare was not related to the injury being settled

- Medicare made a duplicate payment to the provider and to the primary payer for the same date of service

- An unauthorized provider was used while the primary payer provided appropriate care

*** Be aware of time deadlines involved with issuance of Conditional Payment Information.

3. Request the Final Demand and Reimburse the Medicare Lien:

Medicare’s right of recovery does not arise until after payment is received from a primary plan. Accordingly, after a case settles, the CRC must be contacted for a Formal Demand for Recovery. Reimbursement must then be made to Medicare within 60 days of receipt of the settlement proceeds. A pro-rata reduction of the lien is made for attorney’s fees and litigation costs.